Budgeting for Loan Repayments: Manage Your Finances Like a Pro

Absolutely, understanding how to budget for loan repayments is crucial for managing finances effectively and ensuring timely payments without undue stress. Here’s a comprehensive guide on budgeting strategies to handle loan repayments like a pro.

Importance of Budgeting for Loan Repayments

1. Financial Planning

- Helps allocate funds for loan payments within the overall budget.

2. Avoids Defaulting

- Ensures timely payments, avoiding late fees and negative impacts on credit scores.

3. Maintains Financial Stability

- Aids in balancing loan repayments with other essential expenses, promoting financial stability.

Assessing Current Financial Situation

1. Total Monthly Income

- Calculate all income sources, including salaries, side hustles, or passive income.

2. Fixed Expenses

- List essential expenses like rent, utilities, groceries, and insurance premiums.

3. Debt Obligations

- Note down all existing debt repayments, including loans, credit cards, or other liabilities.

Calculating Available Income for Loan Repayments

1. Identify Disposable Income

- Subtract fixed expenses and existing debt payments from total monthly income.

2. Budgeting for Loan Payments

- Allocate a portion of the disposable income for loan repayments while considering other financial goals.

3. Emergency Fund Allocation

- Set aside a portion for emergency savings to handle unexpected expenses without disrupting loan payments.

Creating a Loan Repayment Budget

1. Prioritize Loan Payments

- Ensure loan repayments are a top priority within the budget to avoid defaulting.

2. Account for Interest and Fees

- Factor in interest rates and any associated fees when planning repayment amounts.

3. Flexible Budgeting

- Adjust other discretionary expenses to accommodate loan payments if necessary.

Strategies for Effective Loan Repayment Budgeting

1. Use Budgeting Tools

- Utilize budgeting apps or spreadsheets to track income, expenses, and loan repayments.

2. Automate Payments

- Set up automatic payments for loans to avoid missing deadlines and late fees.

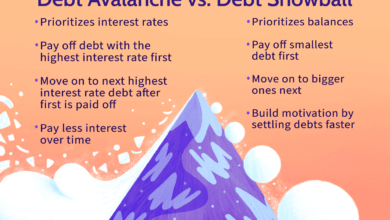

3. Snowball or Avalanche Method

- Consider debt repayment strategies like the snowball method (paying off smallest debts first) or avalanche method (tackling highest-interest debts first) for effective repayment.

Managing Cash Flow for Loan Repayments

1. Aligning Payment Dates

- Coordinate loan repayment due dates with income receipt dates for smoother cash flow management.

2. Budgeting Buffer

- Maintain a buffer in the budget to handle fluctuations or unexpected changes in income or expenses.

3. Regular Budget Reviews

- Periodically review and adjust the budget to accommodate any changes in financial situations.

Allocating Windfalls or Extra Income

1. Direct to Loan Repayment

- Allocate any unexpected income, tax refunds, or bonuses towards accelerating loan repayments.

2. Building Emergency Funds

- Consider dividing windfalls between loan repayments and emergency savings for a balanced approach.

3. Avoiding Lifestyle Creep

- Be cautious with increased income and avoid inflating lifestyle expenses excessively.

Communicating with Lenders or Servicers

1. Discuss Repayment Options

- Contact lenders to explore flexible repayment plans or options during financial difficulties.

2. Refinancing or Consolidation

- Explore options like loan refinancing or consolidation for more manageable repayment terms.

3. Seeking Assistance

- Inquire about hardship programs or assistance offered by lenders during financial hardships.

Balancing Loan Repayments with Financial Goals

1. Long-Term Financial Planning

- Evaluate the impact of loan repayments on long-term financial goals like retirement savings or investments.

2. Prioritize High-Interest Debts

- Focus on high-interest debts first to reduce overall interest payments and accelerate debt freedom.

3. Investing in Future Goals

- Allocate a portion of income towards future financial goals like education, homeownership, or retirement.

Adapting to Financial Changes

1. Reassessing the Budget

- Regularly review and modify the budget in response to changes in income, expenses, or financial goals.

2. Celebrating Milestones

- Acknowledge progress made in loan repayments and use it as motivation to stay on track.

3. Seeking Professional Guidance

- Consider consulting financial advisors or credit counselors for expert assistance in managing loan repayments and overall finances.

Conclusion

Budgeting for loan repayments is a crucial aspect of effective financial management. By assessing income, expenses, and existing debts, individuals can create a well-structured budget that accommodates loan repayments while maintaining financial stability. Employing budgeting tools, exploring repayment strategies, and staying adaptable to changes in income or expenses contribute to successful loan repayment management. By prioritizing timely payments, optimizing cash flow, and seeking assistance when needed, individuals can navigate loan repayments effectively and progress towards financial freedom and stability.