Negotiating Loan Terms: Tips to Secure the Best Deal possible

Absolutely, negotiating loan terms can significantly impact the overall borrowing experience, potentially saving money and securing more favorable terms. Here’s an extensive guide on negotiating loan terms to help individuals secure the best deals possible.

Importance of Negotiating Loan Terms

1. Cost Savings:

- Negotiating can lead to lower interest rates, reduced fees, and overall cost savings throughout the loan term.

2. Enhanced Flexibility:

- Customizing repayment schedules, terms, and conditions can better align with individual financial capabilities.

3. Improved Loan Experience:

- Negotiating empowers borrowers, fostering a more satisfactory and personalized borrowing experience.

Understanding Loan Terms and Components

1. Interest Rates:

- Familiarize yourself with prevailing rates to negotiate competitive interest rates based on market conditions and creditworthiness.

2. Fees and Charges:

- Identify all potential fees, including origination fees, prepayment penalties, and closing costs, for negotiation opportunities.

3. Repayment Terms:

- Negotiate loan durations, installment amounts, and flexibility in payment schedules according to individual financial needs.

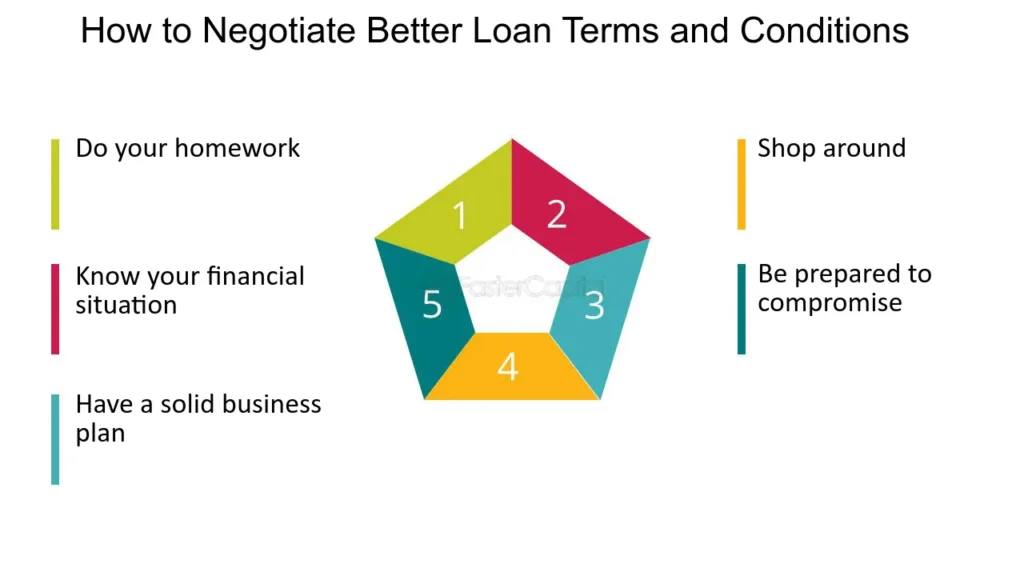

Preparation for Loan Negotiations

1. Know Your Creditworthiness:

- Understand your credit score and financial standing to leverage a stronger negotiating position.

2. Research Loan Options:

- Compare offers from multiple lenders to understand prevailing rates and terms for effective negotiation.

3. Identify Your Goals:

- Determine specific terms you want to negotiate, such as lower interest rates, reduced fees, or flexible repayment schedules.

Tips for Effective Loan Negotiation

1. Highlighting Your Creditworthiness:

- Emphasize your strong credit history, income stability, and financial responsibility to negotiate favorable terms.

2. Seeking Multiple Quotes:

- Use competing offers as leverage to negotiate better terms and rates with your preferred lender.

3. Leveraging Relationships:

- Existing relationships with a lender or banking institution might provide negotiation leverage.

Effective Negotiation Techniques

1. Start with a Competitive Offer:

- Begin negotiations with a solid understanding of the market rates and terms for a strong starting position.

2. Remain Flexible:

- Be open to compromises while negotiating terms to find a mutually beneficial agreement.

3. Focus on Total Cost:

- Emphasize the importance of the total cost of the loan rather than just monthly payments to gauge the overall benefit.

Negotiation Strategies for Different Loans

1. Mortgages:

- Negotiate interest rates, closing costs, and loan duration to secure better terms in a competitive mortgage market.

2. Personal Loans:

- Focus on reducing origination fees, prepayment penalties, and securing lower interest rates based on credit history.

3. Auto Loans:

- Negotiate interest rates, loan duration, and potential dealer fees to secure a better deal on auto financing.

Building Rapport and Communication

1. Professional Communication:

- Maintain professionalism and clarity in communication to convey seriousness and commitment.

2. Ask Questions:

- Seek clarification on terms, fees, and conditions to ensure a comprehensive understanding before finalizing negotiations.

3. Expressing Interest in Long-Term Relationships:

- Indicate willingness for future business or long-term relationships to incentivize lenders to offer better terms.

Closing the Negotiation

1. Reviewing Final Offer Carefully:

- Thoroughly review the final proposed terms before agreeing to ensure they align with the negotiated terms.

2. Obtaining Written Agreements:

- Request written documentation outlining the agreed-upon terms to avoid misunderstandings.

3. Considering Legal Consultation:

- In complex negotiations, consider legal advice to ensure the terms align with your best interests.

Conclusion

Negotiating loan terms empowers borrowers to secure more favorable borrowing conditions, potentially saving money and ensuring terms that align with individual financial goals. Understanding the components of loans, effective negotiation techniques, and leveraging market research can significantly impact the outcome of negotiations. By preparing thoroughly, employing effective negotiation strategies, and maintaining clear and professional communication, borrowers can successfully secure the best possible loan terms, leading to a more cost-effective and satisfactory borrowing experience.